Giving Thanks with RESULTS!

Thank you to the client who had the desire to improve her life and take the necessary steps to accomplish her goals. She could not buy the home she wanted for her kids if she didn’t have Great Credit. Thank you to the Realtor who referred the client to us. Your trust in our company […]

How to Legally Manipulate Credit Scores

Would you like to know how to legally manipulate the FICO score? In this secret tip, I’ll be teaching you how to do just that! The FICO score is nothing more, nothing less than a mathematical formula. Knowing this formula is key to having an awesome credit score. A FICO credit score can be as […]

CFPB Report Confirms Credit Reporting of Medical Debt is a Racial Justice Issue

15 Million Americans with Medical Debt on Credit Reports Disproportionately Live in the South and in Low-income Communities WASHINGTON – A study released by the Consumer Financial Protection Bureau (CFPB) yesterday shows that, despite changes by Equifax, Experian, and TransUnion to reduce the number of medical bills on credit reports, 15 million Americans still have more than […]

Unleashing Financial Freedom: The Impact of Restoring Your Credit and Optimizing Your Credit Scores!

In the bitter world of personal finance, your credit score holds significant sway over your financial trajectory. This numerical representation has the potential to unlock opportunities for improved interest rates, favorable loan terms, and overall financial well being. This Blog will delve into the compelling rationale behind the essential process of restoring and optimizing your […]

Medical debt on your credit report may soon disappear!

Starting this summer, Medical Collections will start to be removed from millions of credit reports. The move will remove an estimated 70% of negative medical debt remarks, giving many a hopeful jump in credit scores! Here are the details of the new changes effective July 1, 2022: Paid medical debt that was in collections will […]

Collection Company Scam Alert!

Hundreds of thousands of consumers are being bombarded with robo calls from scammers posing as collection companies or debt collectors from attorney offices. Sometimes these calls go straight to voicemails where these scammers are leaving very scary and intimidating messages that a debt is owed. The caller or message asks for the consumers to set […]

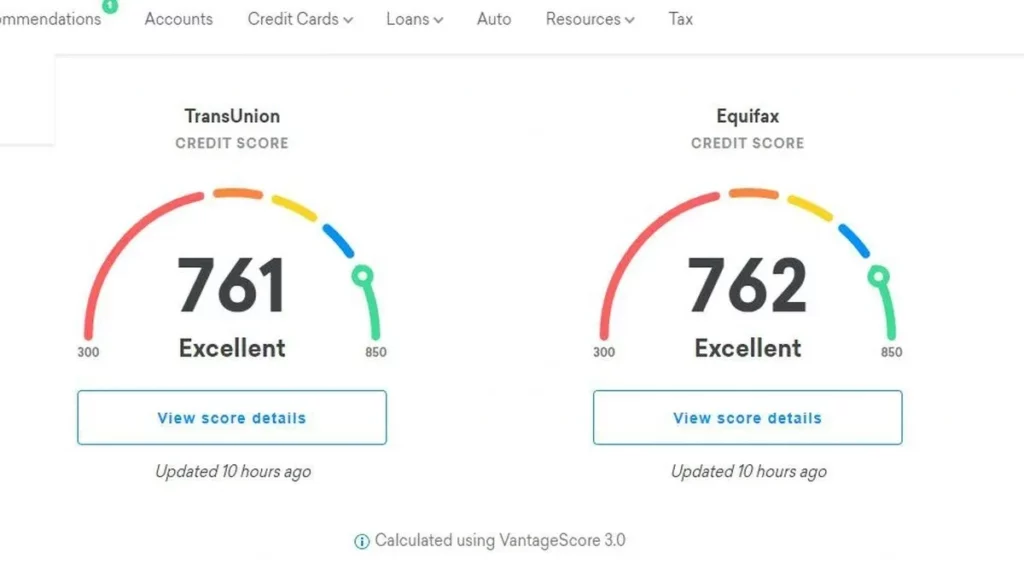

STOP using Free Sites!

As a Credit Industry Professional for the last 16 years, I have preached to people to stop using the Free Credit Score and Free Credit Report websites. I say this to protect consumers from getting inaccurate and incomplete information from these sites and protect their rights to their personal information and data which they give […]

Staying Financially Organized

Staying organized is essential to being financially successful both personally and professionally. Your credit is your #1 Asset and the starting point for being financially organized. Your credit worthiness can be the determining factor with rent, utilities, insurance, interest, loans, benefits and employment. Those with low credit scores are missing opportunities to build wealth and […]

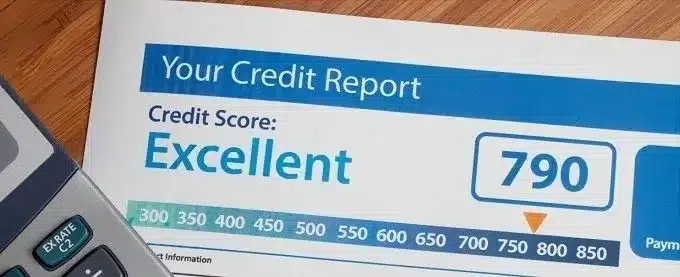

Top Benefits of Having a Good Credit Score

You can survive with bad credit, but it’s not always easy or fun and definitely not cheap. Having a good credit score will help you save money and make your life much easier. If you’re looking for inspiration to improve your credit score or reasons that you should maintain your good credit, here are some […]

Building Credit with a Savings Secured Line of Credit

How a savings secured loan can help you rebuild credit With a savings secured loan, your savings account, money market account, or certificate of deposit (CD) acts as collateral. In return, you get the credit you need. Here’s how a savings-secured loan works: You pledge part of your savings. The lender then places a hold […]