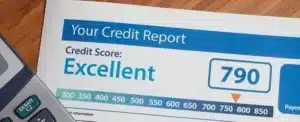

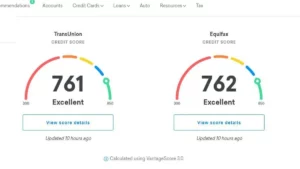

CONSUMER ALERT: Be aware that when you’re purchasing a vehicle that a completely different credit score is being used. The base FICO score ranges from 300 to 850, but FICO Auto Scores range from 250 to 900. Five major factors contribute to the FICO auto score and requirements to get...

Read More